Understanding Crypto Bull Runs

Investors in the cryptocurrency market often seek insights into crypto bull run, a period of significant price growth and excitement. This article explores bull runs, the impact of Bitcoin halvings, how to prepare for the next bull run, when the next bull run is expected to occur and Cryptocurrencies expected to explode during the bull run

When Might the Next Bull Run Happen?

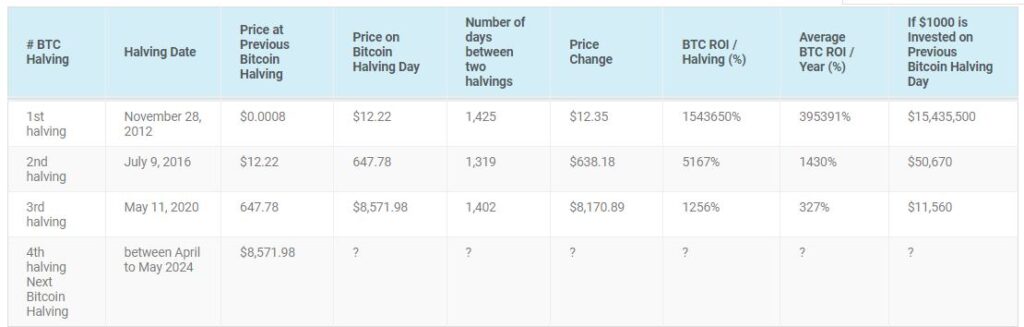

A bull run signifies a time of surging crypto prices, like those in 2013, 2017, and 2021. While predicting exact dates is challenging, Bitcoin halvings, which occur every four years, can be a catalyst and factor in determining the expected date for a bull run. The next halving is expected in April 2024, possibly sparking a price surge in 2025, as seen in previous cycles.

The Expanding Crypto Landscape

The crypto market has evolved beyond Bitcoin. As of 2023, advanced cryptocurrencies like DeFi, NFTs, enterprise blockchain tech, and web3 took center stage. Factors like institutional adoption, major brands’ acceptance, and pandemic-induced inflation fears contributed to market optimism, attracting new investors. Although, few investors are still wondering if cryptocurrency is a good investment

Read Also: How to get Your Pi KYC application approved within 15minutes

Furthermore, certain countries have gone a step further by introducing cryptocurrency payment options. This means that everyday individuals now have the means to own and use cryptocurrencies. This inclusive approach has played a significant role in fostering widespread acceptance and adoption of cryptocurrencies.

What are the Factors Shaping the Next Bull Run

The four-year cycle theory is popular in crypto bull runs, but the crypto market is complex and influenced by various factors. Timing the next bull run precisely remains elusive. Investors must stay informed, and monitor the market to make informed decisions.

The concept of a crypto bull market now encompasses periods of overall growth and enthusiasm. While predicting exact bull run timing is uncertain, the industry continues to grow and innovate. Investors should stay vigilant, conduct thorough research, and adapt to market changes to find success in this evolving crypto landscape.

Bitcoin Halving

The term “Bitcoin halving” refers to a mechanism built into the Bitcoin protocol that adjusts the rate at which new Bitcoins are created, or “mined.” Every 210,000 blocks mined (roughly every four years), the block reward for miners is halved. This mechanism is designed to control the inflation rate of Bitcoin and ensure that the total supply of Bitcoin remains limited.

Halving events have historically resulted in increased demand and price appreciation for Bitcoin. So, Bitcoin halving is a mechanism that helps to keep the cryptocurrency’s supply and demand in balance.

The halving mechanism can have a big impact on Bitcoin’s price and the overall crypto bull run. Historically, halving events have been followed by periods of increased demand and price appreciation for Bitcoin. This is because the reduced supply of new Bitcoin means that the existing supply becomes more valuable. Additionally, the increased scarcity of Bitcoin can attract new investors, further driving up the price.

How to Prepare for the Next Bull Market?

To prepare for the next crypto bull run, consider leveraging on the following:

1. Accumulate USDT: Given the inherent volatility of the cryptocurrency market, it’s wise to stock up on Tether (USDT) before the anticipated bull run. Acquire as much USDT as you can afford, as its value may experience significant upward pressure during such market upswings

2. Portfolio Diversification: The crypto bull run usually comes up with great uncertainty and enough market volatility and this might affect the portfolio as much. Diversifying your portfolio helps reduce this uncertainty in price and helps balance your loss

3. Join the crypto community: Joining the cryptocurrency community during a bull run can be highly beneficial. It provides an opportunity to connect with like-minded individuals and gain valuable insights into expected market developments and events. The crypto community is a source of knowledge, ideas, and support. Engaging with this community through forums, social media, and online groups can help you stay informed about the latest trends, news, and sentiments in the crypto space

4. Do not FOMO: Fear of missing out is something traders should avoid. Do your research properly and enter the trade when all options have been confirmed such as technical analysis and fundamental analysis

Analyzing Past Bull Markets

If we look at past crypto bull markets, we can see some common trends. One of the most notable trends is the so-called “halving effect.” As we discussed, the halving mechanism leads to increased demand and price appreciation in the months and years following a halving event.

The first major crypto bull market occurred in 2013, about a year after the first Bitcoin halving in 2012. In that bull market, the price of Bitcoin went from around $13 in January 2013 to over $1,000 by December of that same year. The second major crypto bull market occurred in 2017, about a year after the second Bitcoin halving in 2016. In that bull market, the price of Bitcoin went from around $1,000 in January 2017 to over $20,000 by December of that same year. In the wake of COVID-19, bitcoin increased from $4000 in March 2020 to $64000 in April 2021.

As a result of the bitcoin price increase, other coins such as eth, LTC, and its like were also projecting higher

What will be the next big crypto?

During a bull run in the cryptocurrency market, many investors and experienced traders become heavily involved in various crypto projects and innovations. Undoubtedly, some coins benefit significantly from this heightened interest and experience a substantial increase in value. We’ve witnessed this phenomenon with coins like Shiba Inu, which saw an astonishing rise of around 40,000,000%, as well as other coins like Pitbull and Solana.

At Penimade, we have carefully selected a few coins that exhibit promising potential and could perform exceptionally well in the upcoming crypto bull run.

3 cryptocurrencies to explode in 2024

Here are cryptocurrencies that could do well in the next crypto bull run

1. SingularityNET

Under the Artificial intelligence coin, singularityNet seems to be a great coin that can perform well in the next bull run. SingularityNET is a cryptocurrency and decentralized AI network built on the Ethereum blockchain. The network is designed to allow AI developers to easily create, share, and monetize their AI applications.

The SingularityNET coin, AGI, is the native cryptocurrency of the network and is used to power the network and pay for services on the network. The coin can be bought and sold on several cryptocurrency exchanges. The SingularityNET project was founded in 2017 and has been gaining traction in the AI and blockchain communities

2. Solana

Solana still has a great potential. In the past bearish market, we saw Solana’s price decrease from 260$ to 25$.

Solana is a blockchain platform and cryptocurrency designed to support decentralized applications (dApps). The Solana coin, SOL, is used to pay for transactions on the Solana network and can also be staked to earn rewards.

The Solana coin has also seen significant price appreciation, with its price rising over 10,000% since its launch in 2017. Solana still has great potential. In the past bearish market, we saw Solana’s price decrease from 260$ to 25$. We predict that Solana will actively outperform many projects while aiming to reach its initial price

3. Shiba Inu

Shiba Inu coin – also known as the “Dogecoin killer” is a meme cryptocurrency and decentralized community project that has become popular for its massive price rallies and active online community. The Shiba Inu coin, SHIB, is an ERC-20 token built on the Ethereum blockchain. It is often seen as a rival to Dogecoin, another popular meme coin.

Shiba Inu, a cryptocurrency that captured significant attention during the crypto bull run of 2021, started with an incredibly low price of $0.000000000056 per token. Fast forward to October 2023, and it has climbed to $0.0000087. Given this remarkable journey, there is anticipation that its performance in the coming years will be equally dramatic, with the possibility of eliminating at least four zeros and potentially reaching a value of $1 following the 2024 bull run.

Planning an Exit Strategy During Bull Run

Having an exit strategy is an important part of investing in crypto, and can help you avoid getting caught in a “fear of missing out” (FOMO) situation when prices are rising. There are a few different ways to plan an exit strategy, but one common approach is to set target prices for selling your coin.

Read Also: 8 Easy Steps On How to Transfer Pi to Mainnet Wallet

Amid a crypto bull run, market prices surge dramatically and your crypto portfolio can swiftly accumulate substantial profits, making it vital to exercise prudence and ensure you secure your gains. One practical approach to this is to set predefined target prices (TP) for selling your assets, each linked to a particular percentage gain.

For instance, you might establish TP1 at a 2x return with a 10% profit margin and TP2 at a 10x return with a 50% profit margin, and so forth.

How long is a crypto bull run?

Cryptocurrency bull runs typically last for a period of several months to years. For example, the 2017 crypto bull run lasted from around mid-2017 to early 2018 while the last bull run in 2021 lasted for about 9months

Leave a Reply