Introduction

In Nigeria, the POS business has emerged as a pivotal player in the realm of financial transactions. Its significance lies in offering convenient and accessible payment solutions to a population with varying degrees of access to traditional banking services. This sector bridges the gap between the unbanked and financial services, fostering economic growth and inclusivity. Leveraging technological advancements, the POS business facilitates swift and secure transactions, influencing the way businesses and individuals engage with money. Are you a business owner or looking to startup a POS business? This article explains all you need to know about the lucrative potential and essential steps to start up a POS business, opening doors to financial empowerment and entrepreneurial opportunities.

Overview of POS Business

In 2013, a pivotal shift occurred in Nigeria’s banking landscape with the introduction of a new banking system by the central bank. This innovative system offered solutions that closely paralleled those provided by traditional local banks. It was during this period that the Point of Sale (POS) system began to gain substantial traction and operate effectively. The implementation of this new banking framework not only marked a significant advancement in financial technology but also ushered in a new era for the seamless functioning of the POS system.

Point of Sale (POS) came to Nigeria with the view of helping individuals, business owner and people living in rural area to have access to their account and perform numerous transaction at their doorsteps. This then encourage a more and faster way of transacting.

For aspiring entrepreneurs aiming to startup a POS business, it’s crucial to grasp that a point of sale agent operates as an autonomous business owner, distinct from being a bank employee. This role entails assuming full responsibility for the business’s profits and financial gains. In essence, these agents function as remote banking facilities, facilitating a range of transactions including withdrawals, deposits, and account openings. Their services extend beyond these fundamentals to encompass tasks such as checking account balances, processing payments for services like Gotv and DSTV subscriptions, and various other functions.

There are lot of businesses one can start with small capital or nothing. Definitely POS business is of the many business that has thrived for the past 5years. This business, not only its lucrativeness, but it good avenue to cash out big. Gradually, point of Sale is replacing the normal functionality of the bank and this has raised some concern in the past but since the naira crunch experienced in the early year of 2023, POS operation has predominantly become so rampant, as well trustworthy, and more efficient for business owners to continue thriving in their business instead of allowing their business to go down the lane due to cash crunch.

How to get your POS Machine in Nigeria

These are steps to follow in other to get POS machine:

- Choose a bank

In Nigeria, there are commercial and microfinance bank that offers the POS services. This bank includes; first bank, Zenith bank, Kuda bank, Opay, palmpay, Monie Point, GTB, Access bank and Polaris bank. In other to choose a bank for this business, ensure you understand the terms and conditions of the bank for the purchase of this machine and the nature of your business.

2. Open a merchant account

When you have choosing the bank of your choice, you will then proceed to open a merchant account in other to be giving a POS machine. The account opening can demand the following document;

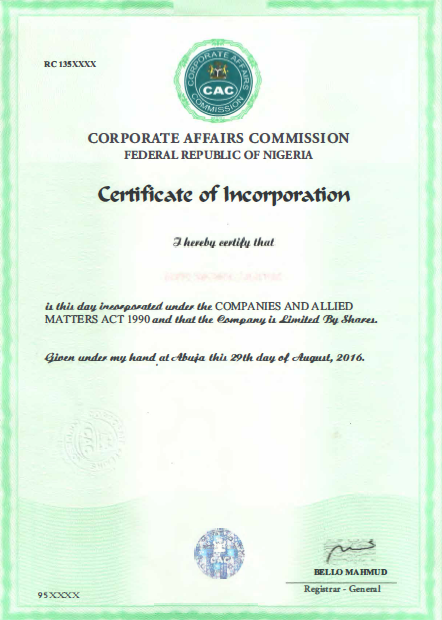

(a) Business registration documents

(b) Your personal identification documents.

3. POS application

Now it’s time to apply for POS terminal machine. The bank might as well ask you to provide some information about your business such as business name, address and contact information. This application approval can take some days because the bank will not just give out their machine to individual or business owners that is not trustworthy or incompetent. They have to investigate the information you provided to ensure you are qualified.

4. Set up your machine

Once your application has been approved and the POS terminal machine given to you, the next thing to do is to install the machine by connecting it to the internet and following the procedure the bank will provide for installation.

5. Start carrying out transactions

You are finally a POS agent! Start carrying out transaction and enjoy your new source of income

How does POS Transactions Work?

As a newbie, you might be wondering how to carry out transaction in this POS machine.

A POS agent carry out transaction through their service provider such as microfinance bank or commercial banks

The agent always have enough cash ready to pay for any withdrawal, which a service fee will be paid by the customer

There are numerous transactions to carry out in this POS business such as bill payment, airtime top up, GOTV, DSTV, StarTimes subscription etc. which attracts a service fee.

For withdrawal, the customer will first insert their debit card into the POS machine and the agent will select the option for the transaction and continue.

The customer 4 digit pin of their debit card will also be required to complete the transaction

A receipt showing declined or approved will be printed from the Machine at the end of each transaction. If it has declined, it means that the transaction was not successful.

Why POS Business?

In Nigeria, POS or Agent banking services has become one of the Nigeria upholder for financial transactions. There are many reasons why this business is very lucrative and flourishing. Some of them are listed below

1. In a landscape where transactions occur daily in motor parks, marketplaces, streets, and shops, the potential for business success is vast. The constant stream of people ensures that there’s always a customer to attend to, creating a conducive environment for a flourishing enterprise. For instance, in bustling marketplaces alone, thousands of transactions transpire each day, exemplifying the boundless opportunities for business growth.

2. The prevalence of poor network connectivity in local banks has prompted individuals to seek alternatives like POS transactions for their financial needs. As a result, the POS has emerged as a reliable workaround to perform essential financial transactions even when traditional banking services face limitations. In fact, statistics show that more than 60% of urban consumers have turned to POS services due to the convenience and reliability it offers in the face of network challenges.

3. The scarcity of ATMs across the country has led to extended queues in banks, hampering customers’ quick access to their funds. This scarcity has fostered an environment where people are seeking quicker alternatives, and POS services have stepped in to fill the gap. Recent data from worldbank reveals that the ATM-to-100,000 adult in Nigeria is about 16.15, indicating the widespread need for accessible and efficient alternatives like POS transactions.

4. The introduction of POS services has contributed significantly to reducing the risk of theft associated with carrying large sums of money. By utilizing POS transactions, individuals can conveniently and securely access their funds without drawing attention to themselves. This trend has led to a notable drop in cases of theft related to cash withdrawals, creating a safer financial environment for consumers. Reports suggest a 30% decrease in theft incidents since the adoption of POS transactions as a primary mode of financial transactions.

5. In a bid to maximize convenience and cut costs, many consumers now prefer to make payments using their ATM cards instead of cash. This shift in consumer behavior has prompted businesses across various sectors to install POS machines in their establishments.

6. In a rapidly evolving economic landscape, the convenience, security, and versatility offered by POS services have led to widespread adoption. Businesses and individuals alike are recognizing the benefits of this innovative financial solution, transforming how transactions are conducted and contributing to the modernization of financial services across Nigeria.

How do POS agent make money?

The POS agents make money through:

1. Transaction Fees: The primary way POS agents make money is by charging a small fee for each transaction they facilitate. This fee is typically a percentage of the transaction amount. For example, if a customer withdraws or deposits a certain amount using the POS machine, the agent earns a percentage of that transaction as a fee

2. Value-Added Services: For entrepreneurs aiming to startup a POS business, numerous POS agents extend their offerings beyond fundamental cash withdrawals and deposits. These expanded services encompass bill payments, mobile phone top-ups, fund transfers, and a range of other conveniences. By providing these value-added services, agents have the opportunity to charge fees, contributing to their overall revenue streams

3. Merchant Services: POS agents can serve as merchants for various companies, accepting payments from customers for goods and services. They earn a commission or fee for every successful transaction they process on behalf of these merchants.

4. Monthly Rentals: In some cases, businesses or individuals might rent POS machines from agents. The agent earns money through a monthly rental fee, regardless of the number of transactions processed.

5. Loyalty Programs: Agents can partner with financial institutions or companies to offer loyalty programs or incentives to customers who use their services. The agent can earn a commission for each transaction made by customers participating in these programs.

How much is POS machine in Nigeria

For those looking to startup a POS business, the investment in acquiring a POS machine in Nigeria typically varies between N25,000 and N85,000, contingent on the service provider. If you’re considering a cost-effective approach, you can acquire a more affordable option for just 25k from any of the banks listed below

Monie Point

Kuda

Opay

Palmpay

What is Cost of Capital to Startup a POS business?

Is it possible to launch a startup a POS business with just 30k? This question, among others, often plagues the minds of aspiring entrepreneurs eager to embark on a POS business journey.

The reality is, you don’t require a fortune to startup a POS business. Depending on your geographical area, initiating this venture can be accomplished with a modest investment ranging from 30k to 200k. Essential ingredients include a strategic location, a POS machine, basic furniture like a chair and table, an umbrella for cover, and a reasonable amount of capital. With these in place, you’re all set to venture into the POS business landscape.”

Conclusion

Startup a POS business and tap into its lucrative potential, with the potential to earn you N5,000 to N10,000 per day. Launch this venture with a modest initial investment and adhere to the right procedures for a successful journey. Remember, there are no shortcuts to success; patience will reward you with significant gains in a surprisingly short time.

I hope this article find you well, bye for now!

Leave a Reply